Spend Less on Housing

For the average American, where they live represents largest single line item in their budget: 16% on average. This makes it the single best item to tackle, however! If you can reduce your housing costs, you’ll likely make the biggest dent in your spending first. And how great will that feel?!

So, how to do it. Well, you may have to move. Sorry. The fact just is that you may have already committed yourself to more housing expense than you need or can afford for the goals you have. If your number one financial goal is to live in the exact situation you have now, then forget this advice and move on. But if that’s not your number one goal; if instead your goal is something like, say, less financial stress (see what we did there?), or any other goal that’s future oriented, then your housing situation is likely holding you back. We know this won’t be a quickly solved problem, but stick with us and learn why it’s worth the effort.

Now, one more thing before we go on: For the sake of this site we are going to use an example family who starts out with exactly the median American income. It’s going to be a family of 3, with one parent working full time and one working part time. Yes, only 41% of families have a child under 18, but we feel it’s more useful to give this “family” a child. 62% of families have both parents employed, so we opted for one being part-time to split the difference. Those statistics, and many others, found here. And to split the difference between average incomes for married and single likely readers, we’re going to give them an income of $75,000 a year. This also happens to be the “magic number for happiness” as determined by a 2010 study, so even though that’s a bit out of date we’re still happy using it as a starting point for our hypothetical family. All on board? Ok let’s go learn about “The Daniels.”

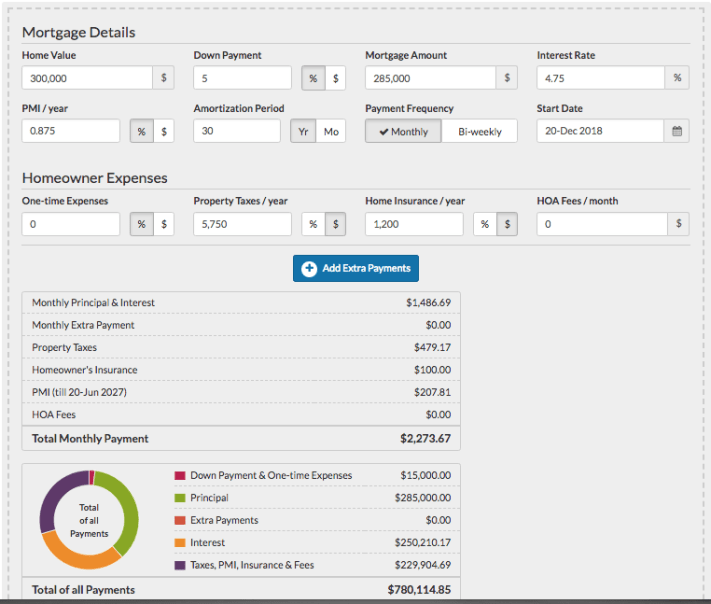

The conventional wisdom for home payments is that it (and any other debt you carry) cannot exceed 36% of your gross pay. So since The Daniels have a monthly gross income of $6,250 that means and so far in this exercise have no other debts, a bank would likely approve them for a payment of up to $2,250. In case you’re unsure, we consider that a BIG NUMBER. That number will not lead to our goal of low stress finances.

Let’s dive deeper into that payment. Remember first that we calculated it from gross pay but need to subtract it from net pay. A quick way to calculate net pay is on the Smart Asset website. Here we find the Daniels’ monthly net income to be more or less $5,200, meaning their approved housing cost would actually be 43% of their monthly budget. If this was in rent, they would create no equity at all (kind of like the “owned value” of their home), and if it was a mortgage then they would slowly create equity, yes, but still rack up a little over…wait for it…$250,000 in INTEREST.

Wow. That’s like 9 years of paying rent, to the bank. In the first year, they’d accrue (create) about $4,500 of equity and pay about $13,500 in interest. This slowly balances each year, but there are additional factors as well. That equity doesn’t a direct line to their bank account if they were to sell the home, because at sales time they’d pay real estate agent commission on the total sales price of easily 4% ($12,000 on a $300,000 sale) plus other fees lumped together and called “closing costs” that may be another 4%. So it would cost them about $24,000 to sell their house. A little more math shows that creating $24,000 in equity would take them 5 years of payments, all the while costing them a little less than $65,000 in interest. So if they sold this home after 5 years, they’d be $65,000 down from where they started with only their downpayment of $15,000 to show for it.

So there are a few lessons here. Of course, yes interest is part of the cost of home ownership and for most people can’t be avoided, but it can be managed. The total amount you pay in interest can be reduced by

- having a greater downpayment (the Daniels had only 5%)

- having a lower interest rate (achievable by having a shorter loan term)

- or paying down the loan amount (called the principal) faster.

These can be achieved in various ways, but our focus on this site is having a less expensive house.

Remember that our primary goal is “spend less than you earn.” So, the $300,000 house the Daniels qualified for is the primary problem. That $2,250 payment came down to about $785 per month on home insurance and taxes and in the first 5 years (more on why this number is constantly changing later – it’s called amortization if you’re really interested now – but for now let’s use round numbers) an average of $400 a month on principal and $1,100 on interest.

Here’s the site for you to calculate your further numbers.

A $1,600 payment could be achieved if they purchased a $200,000 home instead of $300,000. Right off the bat this lowers their total interest over the course of the loan to $166,000. But they can still get that lower. They have a couple options for using the savings in required mortgage payments.

- They could reduce their loan term from 30 years to 15. This would still give them a lower monthly payment than the $300,000 house, coming in at $2,100 a month, and lower the total interest paid over the course of the loan to $76,000.

- They could keep the 30 year mortgage but choose to pay additional $500 principal payments each month, bringing interest down to $75,000 and actually shortening the term of the loan to 14 years.

- They could even pay that full $2,250 and bring their numbers to $65,000 and 12 years.

- Or, if they prefer to pursue lifestyle goals in the 30 years of their mortgage, they could still have $318,000 more to spend on cars, vacations, shopping etc. All for the cost of a smaller or simpler home.

Is that sinking in? Let’s summarize. The 36% of gross pay figure that mortgage companies bat around is great for them but likely terrible for you. At the end of the day, it’s really just what they’ve found to be the most they can squeeze out of you without you defaulting on your loan. People can usually still get by without filing for bankruptcy while paying 36% of their gross income in debt payments. Now, yes, the numbers above did assume no other debt payments, but they still shed a lot of light. As we go on to different budget areas, we will have to revise those numbers, but the hope is you already see how much a home loan really costs in interest. And the parallel to the rental situation should also be easy to see. That’s the goal for now.

So let’s go on to transportation next.